And other likely top market movers this week

The following is a partial summary of conclusions from our weekly fxempire.com analysts’ meeting in which we share thoughts and conclusions about the top likely market movers for the coming week and beyond. These lessons apply to virtually all liquid global asset markets, particularly currencies, equities, commodities and bond markets.

With most major stock indexes near all-time highs, last week’s packed calendar that proved full of market moving surprises, and a very light economic calendar this week that’s almost empty of top tier events, this week has the feel of a quieter consolidation week.

Where Surprises May Yet Lurk

The big exception will be assets directly impacted by last week’s big surprises:

The ECB Rate Cut: Will EU Stocks Respond To ECB Easing?

With the ECB now officially in easing mode (and with good reason, as we discussed here), expect the EUR to be under pressure versus its major counterparts, especially the USD, which may continue to feel support into this week from the very strong GDP and jobs reports. Remember, because the USD and EUR are the most widely traded currencies, and the EURUSD is the most widely traded currency pair (about 28% of all currency volume by itself), weakness in one automatically bestows strength in the other. That’s because about 28% of the time when the EUR is bought or sold, it’s done with dollars, and vice-versa.

US Markets: Bearish Good News Vs. Bullish Taper Delay

The strong US GDP and jobs data, even if their reliability is somewhat suspect( Felix Salmon called the jobs reports a “GIGA,” report, “garbage in, garbage out,” an unreliable report because it was based on unreliable data due to the federal shutdown in October). Still, the outlook for the US after last week has clearly improved. Assets that benefit from that data – the US dollar at least, may derive some residual benefits. As for US stocks, QE is what markets want to see, so they will still be prone to sell off on good news and rally on bad news or anything else that suggest prolonged QE.

Given that risk assets remain in multi-year uptrends and near multi-year or all-time highs, that upward momentum means they’ve an upward bias.

With such a light economic calendar, risk assets as a group seemed poised to consolidate this week.

Here’s what might move markets despite the light calendar and early week reduced liquidity from bank holidays in France, Canada, and the US.

Other sources of market moving events are as follows.

Taper Tamper Timing: Speculation Still The Top Market Mover

As discussed here, there are many good reasons for the fed to defer starting the taper until the newly appointed Fed Chairman Janet Yellin is settled in, and no compelling reasons to justify an earlier taper.

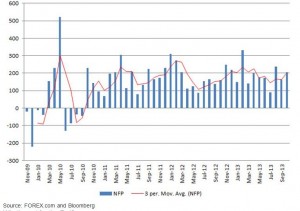

- Regarding the two key metrics the fed is watching, Inflation remains low, and the 3 month NFP moving average has been trending higher only since July, and has only gotten back to where it was at the start of 2013, as shown in the chart below. In sum, neither the inflation nor jobs data offers any compelling reason to taper before the Fed leadership changes in March 2014, at earliest.

Coming Week Market Movers: “Bearish” Good News Vs. Bullish Taper Delay Hopes

Coming Week Market Movers: “Bearish” Good News Vs. Bullish Taper Delay Hopes

04 nov 10 1737

- While the US economic recovery continues to make slow but steady progress, no one is claiming that it has enough momentum to be self-sustaining.

- The fed is clearly following the data, and while recent data has been positive, its accuracy is suspect. See hereand here for examples.

- The composition of the FOMC is in transition in the coming months, and leaving the taper to Chairperson Yellin allows her more flexibility to adjust to changes in data

- Risks from the EU and from the coming third round of the US budget battle in Congress also argue for caution

This week’s calendar is very light, so there is little new information likely to come this week that might materially alter sentiment about the earliest likely start of the stimulus reduction.

ECB Surprise Rate Cut: Ramifications For The Coming Week

The near term bullish effect rate cut by itself was drowned by both:

- –ECB’s omission of any mention of big new liquidity programs to provide continued cheap funding for banks. A new LTRO was not mentioned, and that program ends in 2015. Meanwhile, as we mentioned here, liquidity in the EU has been worsening, and the coming bank stress tests may well cause banks to further horde cash, or deploy it in only the most conservative ways to the most credit-worthy borrowers.

- –The strong US GDP figure, which raised risks of an earlier and faster taper and so sparked a selloff in both Europe and the US

Impact this week:

In stocks: EU stocks should at some point feel some support from knowing the ECB is willing to ease. If the ECB would acknowledge at least a willingness or plan to ease further, that would be especially welcome for the European indexes, given the lack of market moving scheduled events this week.

In forex: The rate cut is significant this week in the context of the Fed’s holding steady while the ECB is now clearly in easing mode. Thus the bias is for the EURUSD to continue its downtrend until it tests around the 1.3250 area, for reasons we discussed here.

China: Growth Continues, But All Eyes On The Third Plenum

Reforms typically take years to implement, so unless markets believe important market-related reforms are coming quickly, this will grab headlines, perhaps move markets in the short term, but is unlikely to have much impact in the coming weeks.

Third Plenums of a new leadership are when reforms are first introduced. The First Plenum introduces the new leadership, the Second Plenum is usually personnel- and Party construction-focused, while the third one is usually seen as the first plenary session at which the new leadership has basically consolidated power and can introduce a broader economic and political blueprint.

Not all third plenums are packed with reforms, but this group of new leaders has repeatedly said it would contain comprehensive and unprecedented reforms, particularly in the economic sphere.

Analysts expect this meeting of the very top leadership to be one of the most ground-breaking in terms of the number and impact of reforms to be announced. There are few details available, but speculation includes:

- A variety of possible steps to liberalize China’s financial markets and allow more foreign investment. That could have a major impact on the liquidity and value of the renminbi if these help it become a more global currency.

- Liberalization of China’s one child policy to help it cope with its aging population

- There are also calls to breakup state enterprises and make China less dependent on exports by encouraging more domestic consumption. However it’s unlikely that there will be much progress in these areas, given the entrenched

Europe: Earnings, Deflation Debt And Banking Issues, And Lessons

As we noted here, the ECB seems reluctant to engage in more exotic forms of easing such as US style QE, or perhaps ceasing to sterilize its ongoing bond purchases. So just a week after having cut rates, expect any further easing activities to be limited to the verbal variety.

We also want to be watching for further news on bank stress tests. Things get interesting when EU leaders start to hash out how banks that fail will get new capital. All solutions impose pain:

- Hit the depositors: risk bank runs

- Hit the bond holders: no more credit or soaring borrowing costs for banks

- Hit the stockholders, also cuts banks off from access to capital, and politicians from campaign funding

- Government bailouts: aka hit the tax payers, politicians risk losing jobs

What’s left? Money printing via some form of special program in which money electronically appears. The financial media might complain a bit, but no one feels much pain until purchasing power gets hit. If there’s deflation, then no worries.

Meanwhile something will have to happen soon to allow GIIPS nation banks needing a cheap source of funding, if for no other reason than so that they can continue buying their own government’s bonds and avoid a new sovereign debt crisis. Per a Reuters report out last week, Italian banks are “near saturation point after two years of buying Italian government bonds. Italy either needs to find new buyers or get more money to the banks to allow them to buy more. That won’t be a problem for the coming bank stress tests as long as the EU continues to observe the polite fiction that all sovereign debt is risk free (!).

DISCLOSURE /DISCLAIMER: THE ABOVE IS FOR INFORMATIONAL PURPOSES ONLY, RESPONSIBILITY FOR ALL TRADING OR INVESTING DECISIONS LIES SOLELY WITH THE READER.